Payments System Webinar

He built payments systems at Square, Varo, and BlackRock. Watch him explain how to scale a payments system.

Sign upInnovative fintech organizations built from the ground up to be agile, data-driven, and cloud-native are driving traditional banks and financial services organizations to adopt cloud-native infrastructure. In order to remain competitive and relevant, banks are modernizing operations, replacing legacy systems like Oracle, IBM DB2, and others. Moreover, to keep pace with fintech organizations, banks are turning to the cloud.

Financial services organizations have different infrastructure requirements than most companies undergoing a digital transformation. For one, the stakes are much higher due to the highly-regulated nature of banking and the critical role these organizations play in global economies. They process a huge number of transactions which means their applications are typically distributed and use many different types of data.

We have a highly complex transaction environment where we are continually searching for simplicity, scalability, and robustness.

–Gabriel Melo, Engineering Manager at Nubank in a case study for Cockroach Labs

Another differentiator for banks is that they typically run on a complicated base of legacy systems and mainframes that have been around for 20 plus years. The organization’s mission-critical, high-risk workloads are deeply ingrained in these systems.

This was the case for an American financial data firm when it started its journey to modernize its application architecture. The company was frustrated by its legacy Oracle database architecture, which had grown in size and number through acquisitions over the years and spanned data centers across the globe.

It’s time for banks to embrace the cloud

Though their requirements may differ, the cloud offers financial services organizations numerous benefits over traditional on-premises models. It empowers organizations to keep up with demand and competition with flexible and scalable solutions for developing, deploying, and maintaining applications. The cloud also provides more accessible data which organizations can use for timely insights to guide decision-making and enable automation.

As many experts have said, every company is now an IT company. The financial services industry is no exception. Feature-rich applications and websites from the likes of Facebook and Google have driven customer expectations sky-high. Consumers demand seamless experiences driven by real-time data. For financial services organizations, this means that if an existing customer applies for a loan, they expect an instant quote on rates, or, if a new customer tries to set up an account, they want it created on the spot.

Banks need to scale just like today’s biggest IT companies. To do this they must modernize their applications and infrastructure and attract the top talent to stay ahead of the competition.

A search of LinkedIn finds that the number of people employed at top financial services organizations with the title of engineer, database administrator (DBA), or developer is:

- 36,000 at JPMC

- 26,000 at Wells Fargo

- 8,800 at Deutsche Bank

- 8,600 at Goldman Sachs

Sticking with legacy systems like Oracle and IBM DB2 comes with inherent risks. These include a lack of staff who can manage these older systems, high costs associated with keeping them going, and the risks that come when migrating off of them, including lost data or data ending up in the wrong hands. The only option now is for banks to move to the cloud to take advantage of the latest technologies that deliver unparalleled performance and enable them to offer more services and meet fast-changing customer demands.

Focus on infrastructure

Since financial services organizations need to interface and interact with legacy systems that contain critical, deeply integrated backend infrastructure, their digital transformations often look different. Unlike in other industries, many of the mainframes deployed decades ago in financial services are still regarded for the high performance, availability, and security they provide. Banks need to find a balance between incorporating the data and services from these distributed systems and harnessing the improved performance and reduced latency provided by the cloud. This may mean integrating the old with the new or completely writing off old infrastructure to start from scratch.

In the case of the American financial data firm, the team ruled out a direct lift-and-shift migration of their legacy Oracle database systems since they were very expensive and were not for multi-cloud deployments. They turned to CockroachDB for a completely new solution to modernize applications that covered their nine physical and cloud regions worldwide. They decided on a hybrid approach, keeping some data on-premise and moving other data to Google Cloud Platform (GCP).

Like this data firm, many banks are moving to cloud-native or hybrid cloud application strategies based on containers and microservices. Compared to traditional monolithic financial services infrastructure, these tools and technologies offer the flexibility to scale up to meet future demand by adding new services. This means organizations can plan not just for now but for three to five years in the future.

Nubank kicked off its transformation by setting up on-premise CockroachDB deployments in three locations. However, as the company continues to grow and expand into new markets, it left itself the option of moving to the cloud and creating a hybrid deployment. In the future, the company is considering migrating some apps to Amazon Web Services (AWS) to create a hybrid deployment across its on-premise servers and cloud regions.

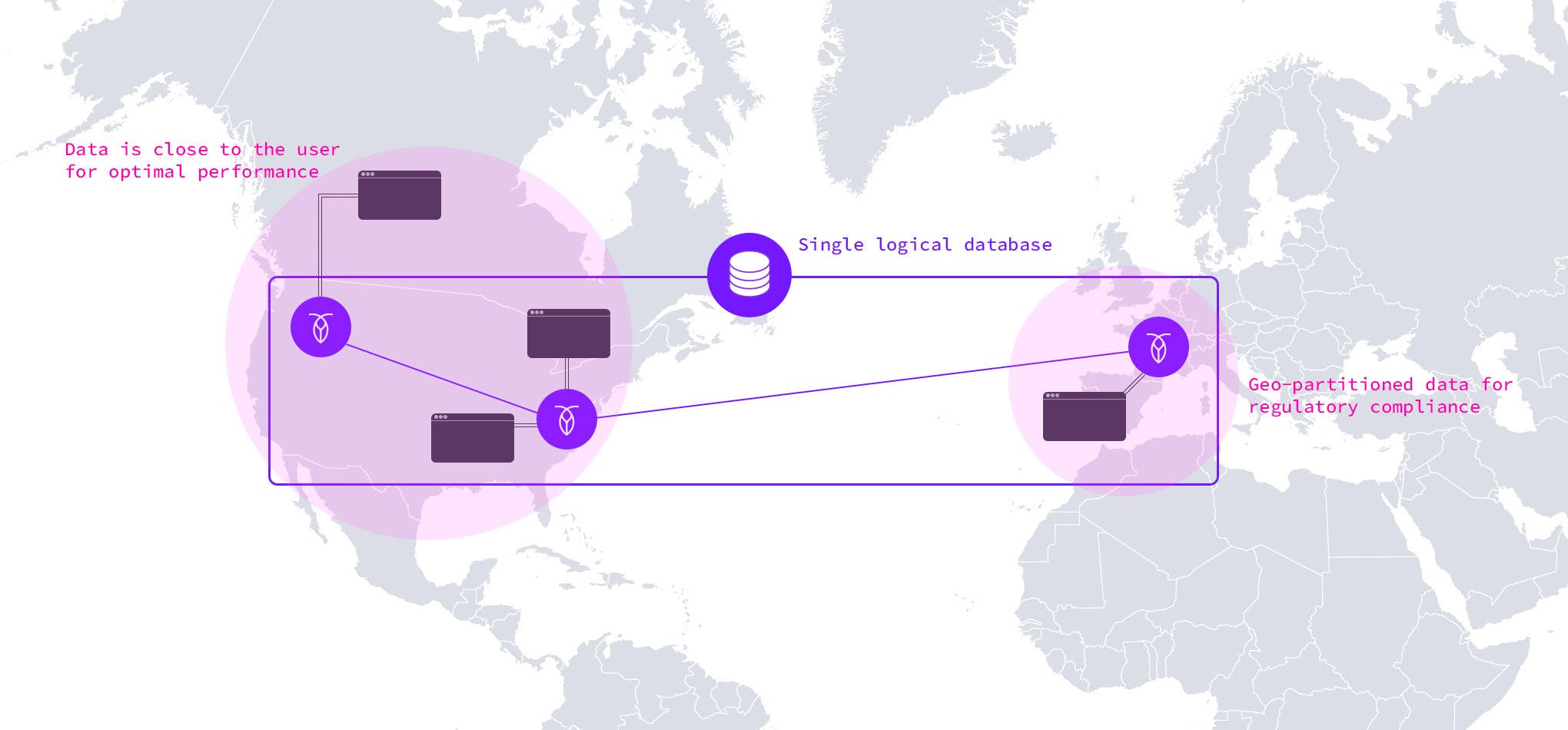

When migrating to the cloud, the main challenge for any organization is to maintain peak application performance. This new breed of distributed applications requires infrastructure that is always-on, resilient, and able to support real-time processing of transactions while ensuring compliance with any local data protection and privacy laws. CockroachDB helps organizations on this path by providing easy-to-use databases that are built to address cloud scalability and performance issues.

Financial services and CockroachDB

CockroachDB has helped some of the world’s largest banks accelerate their transition to a cloud-first infrastructure. It provides an easy way for developers to take advantage of high availability and elastic scalability features to deliver data-intensive applications that guarantee consistent transactions and low latency.

CockroachDB helped Nubank migrate away from storing data on-premise with an in-memory data store. As the organization was growing quickly it needed a transactional solution for some of its credit card authorization services. CockroachDB provided the availability, scale, resilience, and easy maintenance the digital bank was looking for.

The financial data firm adopted CockroachDB as a solution for its cloud-first database strategy which supports the firm as it continues consolidating its datacenter footprint. This migration will enable them to scale and migrate their databases across physical data centers and cloud regions without any downtime.

Global banks, financial services organizations, and fintech companies trust CockroachDB with their critical, transaction-heavy workloads. Download How Financial Service Companies Can Successfully Migrate Critical Applications to the Cloud to learn more.