[ Guides ]

[ Guides ]

Best practices for multi-cloud

Save time and money by approaching multi-cloud the right way.

Get your copy of the reportFounded in 1852 during the California Gold Rush, Wells Fargo was an innovative start-up providing miners secure ways to access money and transport valuable cargo — even operating the western branch of the Pony Express to give customers the fastest possible service. In the 1990s the company once again was a pioneer in financial services innovation when it became the first US lender to provide online banking. Eventually, however, the company started to fall a bit behind the technological curve.

Wells Fargo has now stepped once again to the forefront of fintech, though. Last week, the company announced an ambitious digital infrastructure initiative. The goal is for all of Wells Fargo’s workloads to be running on public clouds (yes, as in multiple clouds, plural) within the next ten years. The company said it will be decommissioning its data centers and moving services to two different public cloud providers, Microsoft Azure and Google Cloud Services.

Check out our 2024 multi-cloud webinar with Erol Kavas, Cloud Architect and Director at PwC.

Why choose multi-cloud?

When one the biggest banks in the world — Wells Fargo serves one in three U.S. households and has $1.9 trillion in assets — embraces multi-cloud, it’s a pretty big deal. Saul Van Beurden, Wells Fargo’s head of technology, told the Wall Street Journal that the company is partnering with multiple public cloud providers because it wants to manage its risk in the cloud, and also because each vendor has different competencies.

According to the company’s September 15th public announcement, Wells Fargo will utilize Azure as its primary public cloud provider for business-critical bank functions and applications. GCS will “drive advanced workloads, and complex artificial intelligence and data solutions, allowing the company to move faster on driving personalized experiences for its customers and clients.”

In fact, the plan is both multi-cloud and hybrid: Wells Fargo also plans to transition to third-party data centers. “These facilities will complement the public cloud offerings of Microsoft and Google Cloud with both private cloud and traditional hosting services to create a secure, resilient, and flexible technology foundation for the company’s transformation.”

Cloud provider redundancy is an understandable priority, given service outage disasters the company has experienced. Like in February 2019 when a fire suppression system accidentally hosed the server room at one of the company’s data centers with extinguishing chemicals, leaving customers unable to access online banking and mobile applications. Another outage in March of 2021 occurred when traffic spiked from bank customers attempting to check their balances on the day that Covid relief stimulus checks were due to land in user accounts. Building for resilience with distributed architecture, a self-healing database and replication via multiple cloud providers is how organizations can ensure outages like these are history.

Wells Fargo is not the first financial firm to move to the cloud. Morgan Stanley announced in June it was shifting core workloads to Azure and Capital One Financial Corp. shifted its data, applications and information-technology systems to AWS in 2020. However, Wells Fargo appears to be the first big bank to publicly bet on multi-cloud.

Moving legacy workloads to the cloud

The company is in, well, good company. A new report from Cockroach Labs and Red Hat shows that multi-cloud is fast becoming the mainstream move.

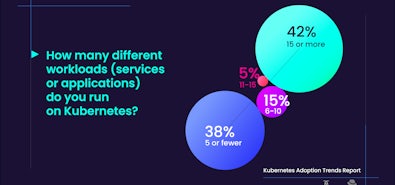

The 2021 Kubernetes Trends Report surveyed technical leaders and architects at 200 US companies about their cloud infrastructure and workloads, and 85% report having an active multi-cloud strategy:

- 54% of all companies surveyed have already moved or are actively migrating their workloads to a multi cloud environment

- 31% plan to do so in the next 3 to 6 months.

Or, as one respondent noted, “Our multi cloud timeline is as soon as possible.” The Kubernetes Adoption Trends study overwhelmingly shows that if companies are not already working in a multi-cloud environment, most of them will be by the end of 2021.

As other industries rushed to the cloud, however, traditional players in the banking industry have been slower to follow. Banks have been slower to move away from their own private data centers and legacy technology in part due to security concerns and regulatory barriers and in part because of the huge task of migrating or replacing their antiquated systems.

However, the Kubernetes Trends Report shows that banks, too, are starting to make the move. Breaking down results by industry, financial companies are somewhat slower to be making the move to multi-cloud. Whereas 100% of respondents from sectors like industrial products, telecommunications and electronics report having an active multi-cloud strategy, those in the financial sector indicate a longer timeline for making the move – and 20% do not plan to adopt multi-cloud at all. The only industry showing a lower rate of multi cloud adoption (and moving workloads to the cloud in general) is healthcare.

Which shows that, once again, Wells Fargo is an organization that is not afraid to innovate — despite the financial sector’s traditionally deep conservatism toward adopting newly arrived technologies. The same way the company once jumped onboard fast horses and steam locomotives, it’s now onboard with multi-cloud.

Download the free 2021 Serverless, Multi-Cloud & Kubernetes Adoption Trends Report for more insight into how systems architects, software engineers and strategic IT thinkers in nearly every industry are strategizing around multi-cloud and serverless environments…Plus detailed data around the types of workloads organizations are deploying in Kubernetes, their production environments, and the kinds of teams they dedicate to managing it all.